is 30 year term life insurance good

If you are considering Term Life Insurance youre likely aware that you can choose between 10 15 20 25 and 30-year terms from most companies. Is 30 Year Term Life Insurance Good.

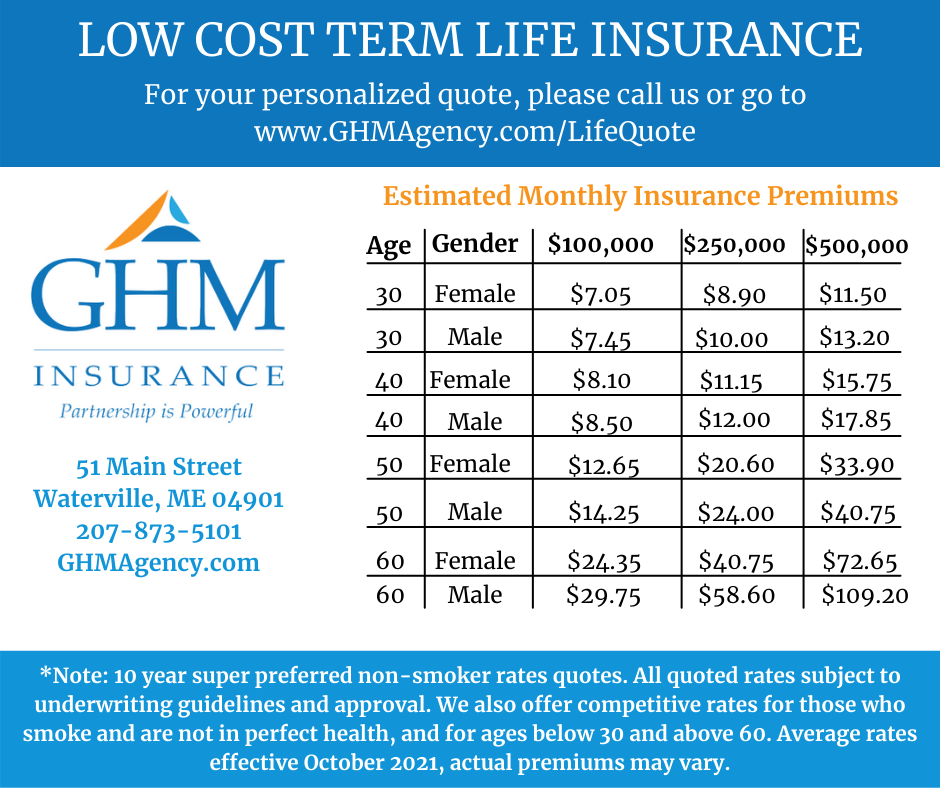

How Much Does 30 Year Term Life Insurance Cost

A 30 year term life insurance policy can be a great choice if you are part of a couple who are financially secure and able to handle the premium difference between a 20 year and a 30 year.

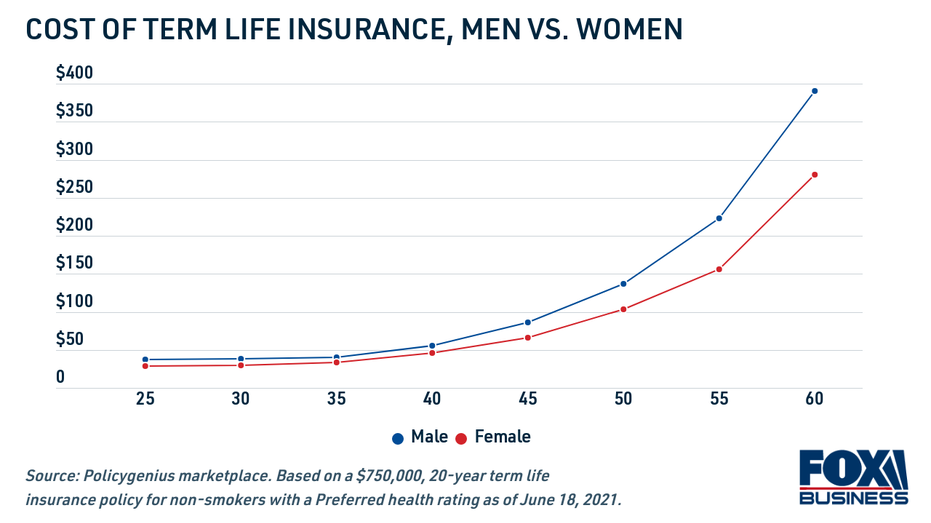

. At age 30 term life insurance rates for males are around 19 more expensive than for females for a 500000 20-year term policy. You are a part of a couple that is laying the groundwork for your future. And the period over which the term insurance coverage is.

When you buy term life insurance you lock in your rate for the level term period such as 20 years. In a term insurance plan the life cover is only valid for a specific period. Insurance providers use your age coverage amount smoking history and overall health to determine your premiums.

By age 40 that premium could. Waiting from age 30 until age 40 to buy can. A 30-year term life insurance policy is a good option for young people in a lot of different life situations.

The Advantages of a 30-Year Term Life Insurance Policy. A 30 year term life insurance policy can be a great choice if you are part of a couple who are financially secure and able to handle the premium difference. The average cost of a 20-year term life policy with the same death benefit would be 300 per year for a 30-year-old male and 252 per.

The premium will be roughly. Term life insurance policies commonly come with a term length of 10 15 20 or 30 years. 30 year term life insurance quotes term life insurance rates chart by age 30 year term life quote 30 yr term life 30 year term life insurance cost term life insurance rates 20 yr term life.

A 30-year term life insurance policy can be a great option for younger adults that are in. Investing in a life insurance policy is an important decision with long-term consequences good or bad. The benefit of this type of policy is that it is typically less expensive than.

This is why it is known as term insurance. For example here are the average rates for policies with. For Males Rates based.

A 30 year term life insurance policy can be a great choice if you are part of a couple who are financially secure and able to handle the premium difference between a 20 year and a 30 year. Generally a 30-year term is the maximum length of coverage offered. At that point it may make.

As we mentioned 30-year term life insurance is a policy that provides coverage for a period of 30 years. Having these choices is a large part of the. Obviously a shorter term policy costs less.

Generally older adults those with health conditions and. A 30-year term life means 30 years the policy expires 30 years after it began. The cost of a 20-year term life insurance policy depends on your age health gender and whether you use tobacco.

A healthy young woman in her 20s who doesnt smoke might be able to get 1 million in 30-year term life insurance for around 45 per month. For example the average life insurance quote only increases by 6 between ages 25 and 30 but it jumps much higher between ages 60 and 65 an average increase of 86 or. Your level term policy will only last for a specific period of time such as 5 15 or 30 years.

Lets start with the lone disadvantage of the 30-year term vs the 20-year. Its challenging to find a term policy that lasts longer than 30 years. Below well give you some examples of the kinds of prices you can expect for your monthly premiums on a 500000 30 year term life insurance policy.

Common options for level term periods are 5 10 15 20 and 30 years with. Your monthly premium and death benefit remains fixed for the length of the policy.

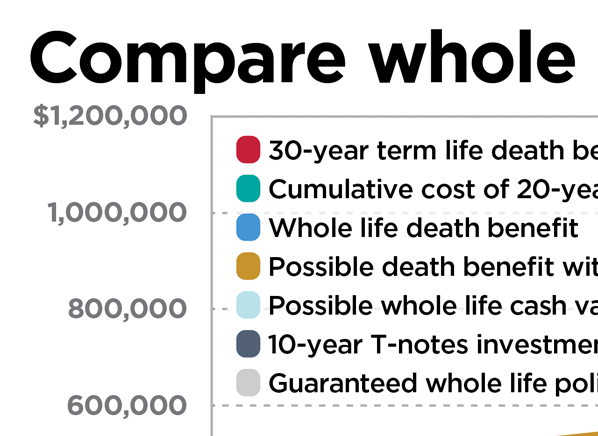

Comparing Term Life Vs Whole Life Insurance Forbes Advisor

/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Term Vs Universal Life Insurance What S The Difference

What Happens If You Outlive Your Term Life Insurance Bankrate

How Long Do You Need Term Life Insurance For

Ghm Insurance Life Disability Insurance

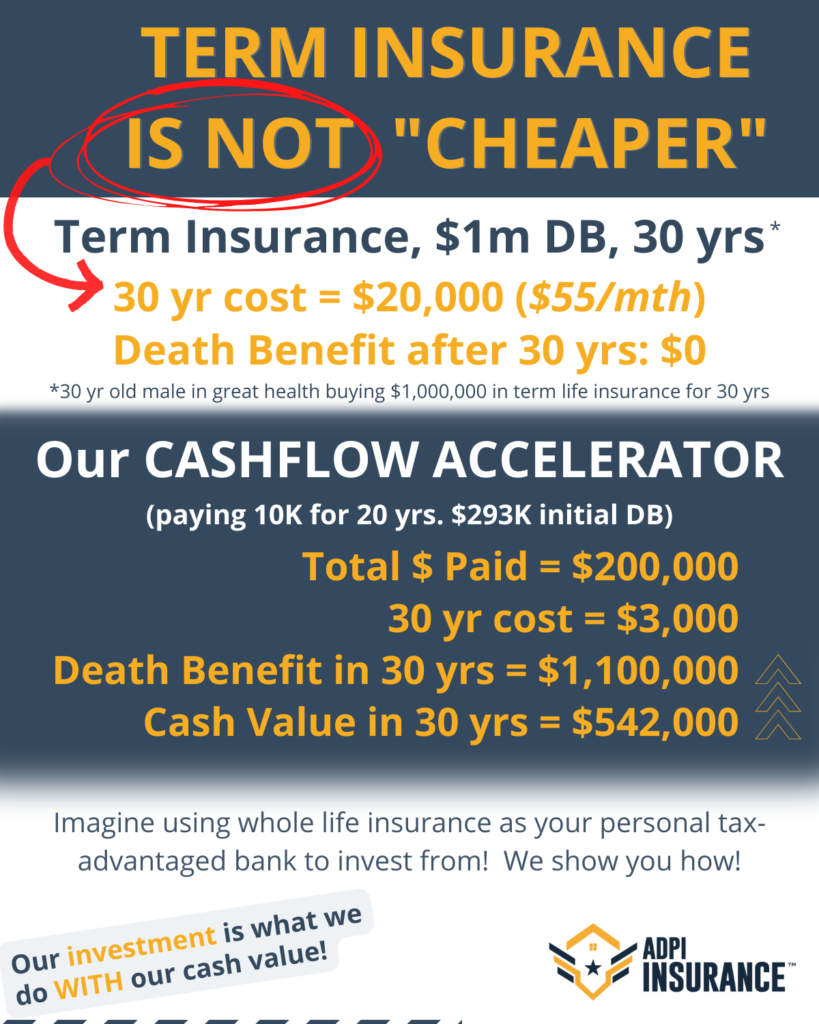

Term Insurance Is Not Cheaper Than Properly Designed Whole Life Insurance Active Duty Passive Income

Average Cost Of Life Insurance By Age Term Coverage Valuepenguin

40 Year Term Life Insurance Guide Cfa Insurance

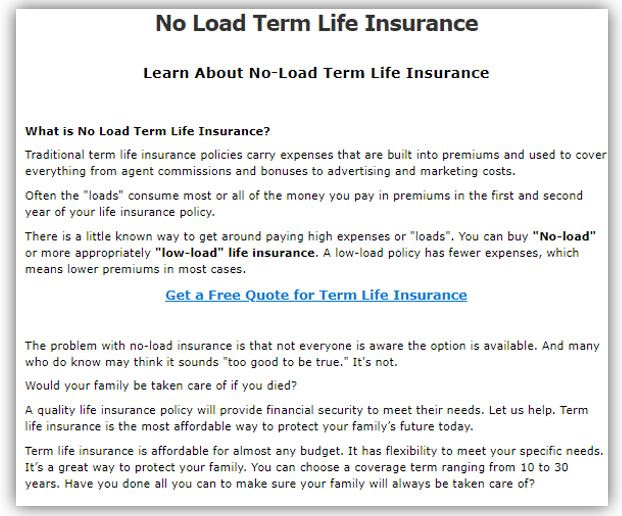

The Impossible Search For No Load Life Insurance Agency One

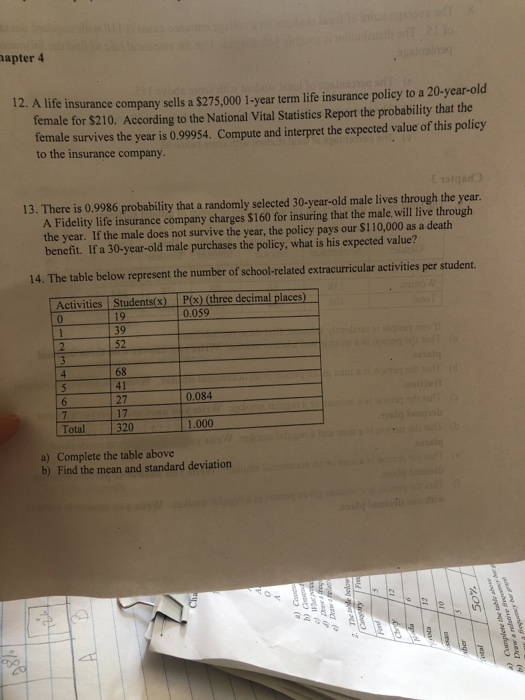

Solved Mapter 4 12 A Life Insurance Company Sells A Chegg Com

Best 30 Year Term Life Insurance Rates In Your Forties 40s Policymutual Com

:max_bytes(150000):strip_icc()/dotdash-term-life-vs-whole-life-5075430-Final-60fb4e8f7bae43e0a65a3fac2431479c.jpg)

Term Vs Whole Life Insurance What S The Difference

Best 30 Year Term Life Insurance Quotes By Age

20 Year Vs 30 Year Term Life Insurance Pros And Cons

How Much Should Life Insurance Cost See The Breakdown By Age Term And Policy Size Fox Business

Who Is 30 Year Term Life Insurance Ideal For Ethos Life